- Dom. Ene 25th, 2026

Latest news

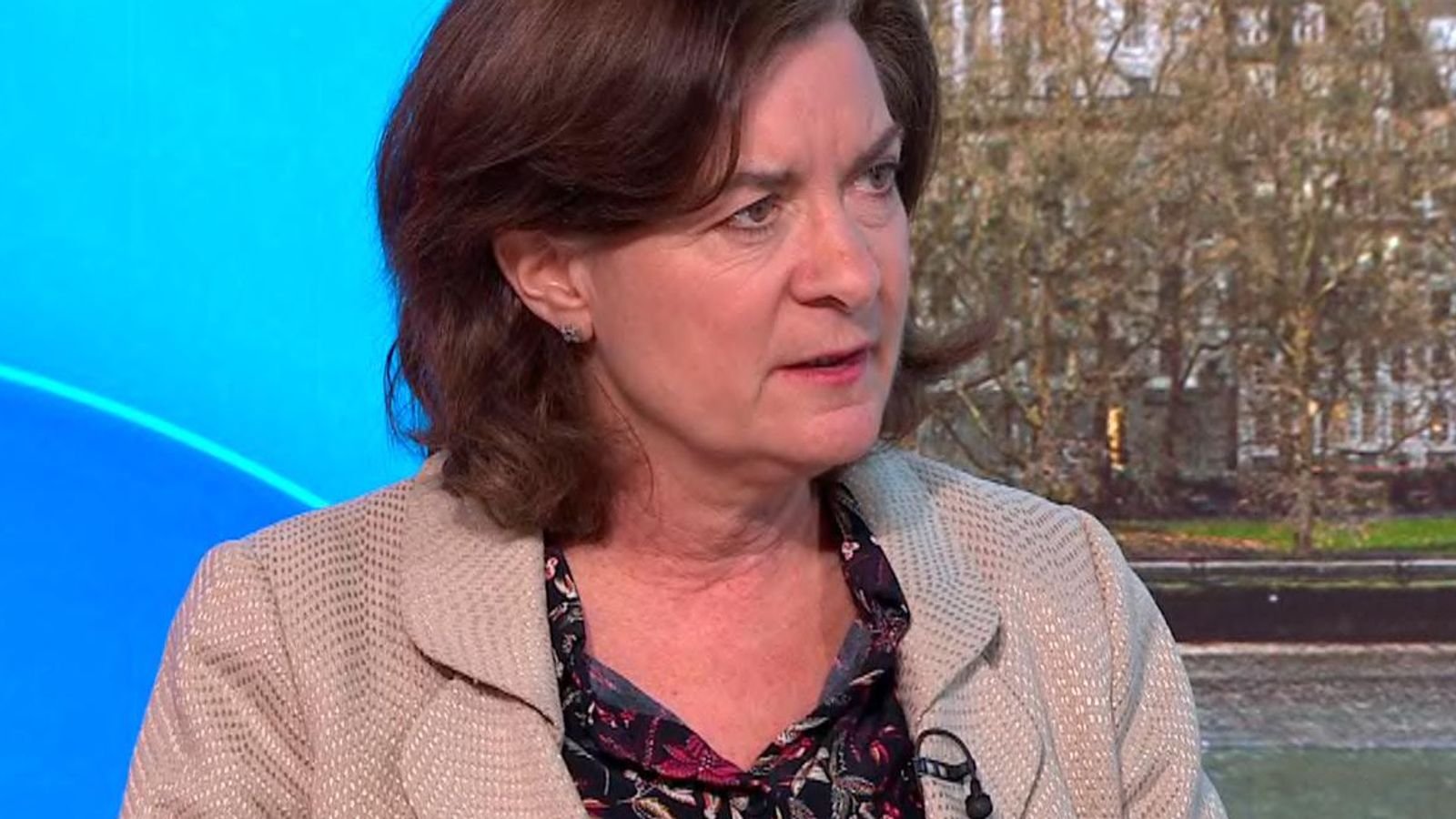

Row over Welsh-only names for new Senedd constituencies sparks controversy

The new constituencies for the Senedd have been given Welsh-only names, in a move criticised by the former leader of the Welsh Conservatives. The number of Senedd constituencies has been…

CVC-backed M Group in talks to acquire Telent for £270m

An infrastructure services provider backed by one of the world’s biggest buyout firms is in advanced talks to buy rival Telent for about £270m. Sky News has learnt that M…

What is tax-free allowance in the uk: everything you need to know

Understanding Tax-Free Allowance: What Is It and Why Is It Important in the UK? Understanding tax-free allowance: what is it and why is it important in the UK? The tax-free…

Boohoo rebrands as Debenhams Group amid strategic review

Boohoo, the struggling online fashion retailer, has rebranded itself as Debenhams Group. The company, which has been embroiled in a dispute with its major shareholder Mike Ashley’s Frasers Group regarding…

Trump tariff confusion leads to spike in uncertainty index.

If you’re already feeling overwhelmed by the sheer amount of news to ingest on Donald Trump’s tariffs plans in recent weeks, well, you’re not alone. One measure of «policy uncertainty»,…

What is stamp duty reserve tax and how does it affect property buyers?

What is Stamp Duty Reserve Tax? Understanding the Basics Stamp Duty Reserve Tax (SDRT) is a tax levied on the purchase of shares and certain other securities in the United…

US shares plummet as Trump refuses to rule out recession

The US economy took another hit on Monday as President Donald Trump expressed uncertainties about a possible recession. Tesla shares plummeted by 15% to $222, marking a significant decline from…

What is the impact of brexit on taxation in the uk and beyond?

Understanding Brexit: An Overview of Its Economic Implications Brexit, the term used to describe the United Kingdom’s (UK) exit from the European Union (EU), has profound economic implications that affect…

Police watchdog near conclusion on Cardiff crash missing person probe

The investigation by the police watchdog into the handling of missing person reports after a tragic crash in Cardiff that claimed the lives of three young individuals is nearing its…